Which Of The Following Statements Is False? In A Perpetual Inventory System, The "Cash Regist

Merchandise businesses can record their inventory with either a periodic inventory system or a perpetual inventory system.

A periodic inventory system records merchandise transactions periodically, usually at the end of the year. Whereas with a perpetual inventory system, all transactions, along with inventory costs and sales of merchandise go recorded immediately as they occur.

In the by, both systems were widely spread.

Nowadays, all the same, with the growing use of automated and digitized software, the perpetual inventory arrangement has become incredibly easy and cost-constructive to implement.

Hence, most businesses, even smaller ones, tend to get for a perpetual inventory organisation equally it ensures more than accurate bookkeeping.

In this guide, we will be explaining what a perpetual inventory arrangement is, its advantages, and whether or not information technology is the right inventory management exercise for your small business accounting.

Read forth to learn almost:

- What Is a Perpetual Inventory Arrangement?

- Periodic vs Perpetual Inventory System

- How Does the Perpetual Inventory System Work?

- Inventory Valuation Methods

- Advantages of Perpetual Inventory System

- Journal Entries for Perpetual Inventory

- Perpetual Inventory Organisation with Deskera

What Is a Perpetual Inventory Organisation?

A perpetual inventory system is an inventory direction method that records each sale or purchase of inventory in existent-fourth dimension, through automated software.

With a perpetual inventory system, each sale or buy of merchandise is updated on a real-time basis automatically, thus providing you with a total financial picture of your inventory levels.

The organisation lets y'all access inventory reports at any time, updates stock levels, and almost completely reduces human errors through automation.

With that existence said, at that place are a few factors that may crave manual input in the system, such as theft, damage, or loss of inventory. Make sure to occasionally cheque your actual concrete inventory and compare the full displayed by the perpetual inventory arrangement.

If you want to learn more about inventory accounting, and how to properly streamline your inventory management process, head over to our consummate guide on inventory management .

Who Uses a Perpetual Inventory System?

When business owners or direction need upwards-to-engagement information about inventory levels , then using a perpetual inventory system is the way to become.

So, for the almost part, large businesses with a high number of sales and several retail outlets, such as pharmacies, and grocery stores crave a perpetual inventory system.

Pocket-size businesses that are looking to expand, or want to take more command over their merchandise, too adopt a perpetual system, as there are plenty of intuitive and depression-price perpetual software options in the market today.

Periodic vs Perpetual Inventory System

While we did explain above the primary departure betwixt periodic and perpetual inventory systems, nosotros did not cover all the core features that differentiate the 2.

With a perpetual inventory, all transactions involving costs of merchandise get recorded immediately as they occur. For instance, take grocery stores - each time a product is bought and scanned, the system updates inventory levels in the database.

In a periodic inventory organization, on the other paw, reports of inventory and cost of goods sold aren't kept daily, only periodically, commonly at the terminate of each fiscal year, or at the terminate of each month. This type of inventory management involves physically counting all your stock (at regular intervals) and cantankerous-referencing that information with the sales data to find whatsoever discrepancies.

As you might take guessed already, this process is extremely tiresome, fourth dimension-consuming, and prone to a lot of errors.

That's why near businesses nowadays, apply perpetual inventory systems to manage their inventory.

Being able to bank check inventory levels and the cost of goods sold, in real-time, can salvage your employees and your business organisation a considerable amount of fourth dimension and money.

If you want to learn more well-nigh the details and uses of periodic inventory, head over to our guide on the periodic inventory organization.

How Does the Perpetual Inventory Arrangement Work?

Every time trade is bought or sold, the perpetual inventory system will continuously update inventory levels automatically. This abiding updating allows businesses to always be aware of their acknowledged goods and services, likewise as, what inventory is running low on supply.

Here is the step-by-step process of how the automation of the perpetual inventory system works.

Step #i: Bespeak-of-Auction System

A point-of-sale or POS organization is the hardware that enables businesses to make sales at a physical store. Through a barcode scanner, the POS organization calculates the cost of the item and updates the inventory count to show that the detail is sold.

Subsequently the customer pays, through a credit carte or greenbacks, the POS system processes the payment, and a digital receipt is created.

Footstep #2: Update Price of Appurtenances Sold

Whenever a auction happens, the perpetual inventory system automatically recalculates and updates the corresponding toll of goods sold.

Step #3: Reorder Bespeak Automation

The sale also triggers an automatic update on inventory levels.

Businesses dealing with inventory accept minimum required stock levels they demand to maintain for every type of good. Whenever a stock corporeality falls beneath this minimum, the system sends out a notification suggesting you to order more than stock.

This is known equally a reorder point.

A perpetual inventory system uses the historical data of the business concern to automatically update these reorder points and keep inventory levels optimal at all times.

Pace #four: Purchase Order Automation

The organization non only updates reorder points only as well generates the buy orders necessary for restocking, with zero homo interference.

In other words, it tin can be fix up to automatically issue purchase orders, whenever stock levels autumn below the required threshold.

Footstep #5: Warehouse Management Software

A perpetual inventory system comes with a warehouse management system (WMS), which is software designed to support and optimize distribution management.

And so, whenever inventory is sent to a warehouse, employees can employ the WMS to easily scan the product. The product will then automatically appear in the inventory management dashboard, available for sale on all sales channels.

Inventory Valuation Methods

In a perpetual inventory system, at that place are three main methods you tin choose from to account for inventory: FIFO, LIFO, and the average method.

1. FIFO

FIFO stands for Commencement-In-Commencement-Out, and it's based on the supposition that the first merchandise bought is the showtime one sold.

To better visualize this method, yous can think of FIFO as a queue. The first person that's queued, is likewise the outset person to get out.

2. LIFO

The LIFO method, or Terminal-In-Beginning-Out method, assumes that the most recently purchased merchandise is sold offset.

A improve way to visualize LIFO is by imagining a stack of plates. The get-go plate (the ane you placed at the bottom), will be the last ane to go out considering y'all'll start accept to remove all the plates that were placed on summit of it.

3. Weighted Average Method

The weighted average method, as well known as the boilerplate-cost method, calculates the toll of merchandise based on the boilerplate cost of all units.

The boilerplate price is computed by dividing the total cost of inventory available by the number of units.

Keep in mind that whichever inventory method a business decides to go with, information technology does not bear on performance. These methods only have an event on the manner income taxes are reported.

For case, depending on price fluctuations, a visitor that wants to appear less profitable in an accounting period in order to pay fewer taxes, can decide to opt in for LIFO instead of FIFO.

If you want to learn more than about how to employ these inventory methods, check out our guide on the unlike inventory valuation methods, with business examples.

Principle of Consistency

The principle of consistency states that, once a business concern has adopted one of the three inventory methods mentioned, they should follow that method consistently.

That doesn't prohibit a concern from always switching their inventory valuation method, though. A modify tin exist made, but the reasons for the change have to be explained, and the business organisation' net income must also be fully disclosed.

Advantages of Perpetual Inventory Arrangement

Real-time Updates

A perpetual inventory organization recognizes changes in inventory levels, as soon as a sale or purchase takes place.

This abiding inventory tracking provides businesses with the advantage of e'er knowing which goods may be running depression so that they can reply on time and avoid stock-outs or shortages.

And if you're managing a big business that operates in several locations and uses several warehouses, a perpetual inventory system allows you to manage everything with ease, through one primal automatic system.

Planning and Forecasting

The perpetual inventory system helps businesses improve their need forecasts by analyzing the data trends from historical transactions.

Businesses can get a better understanding of their customer'south buying patterns, along with insight on best-selling products and growing segments.

Relieve Time and Minimize Error

At that place'southward null improve than automating tedious, repetitive, and time-consuming tasks for you and your employees!

A perpetual inventory system saves your business time, coin, and prevents a handful of human accounting errors that can occur along the manner.

Journal Entries for Perpetual Inventory

When dealing with inventory accounting, you'll likely discover yourself journalizing transactions. Below you'll observe some of the most mutual periodical entries you lot'll demand, to exercise accounting for your inventory.

ane. Purchase of Merchandise at Cost

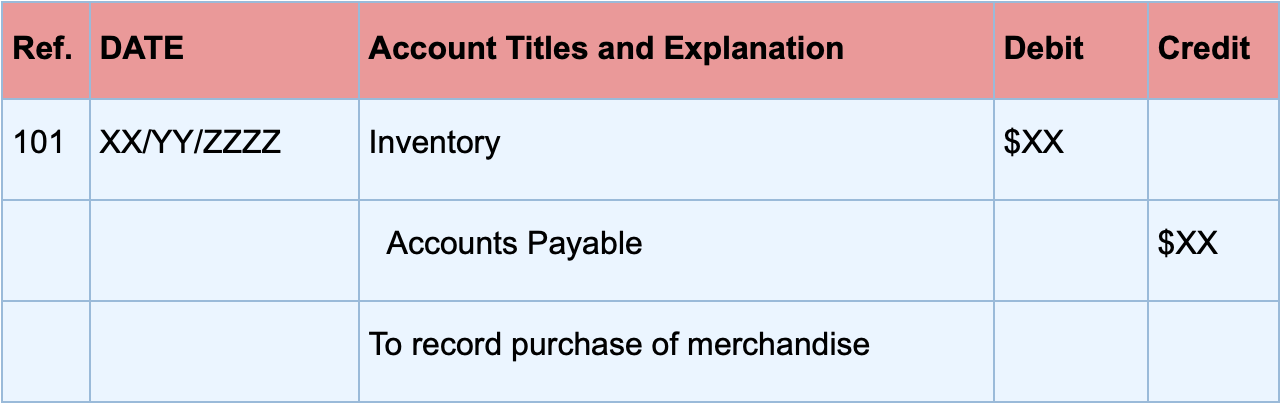

To record the purchase of merchandise at cost, inventory is debited and accounts payable credited, as shown below:

two. Payment of AP

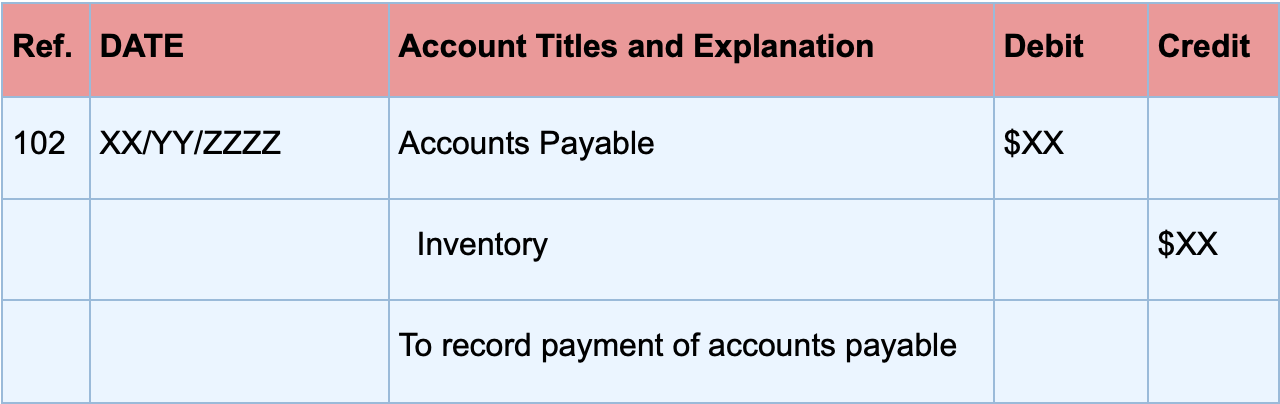

The periodical entry for making an invoice payment would look similar this:

3. Credit Terms

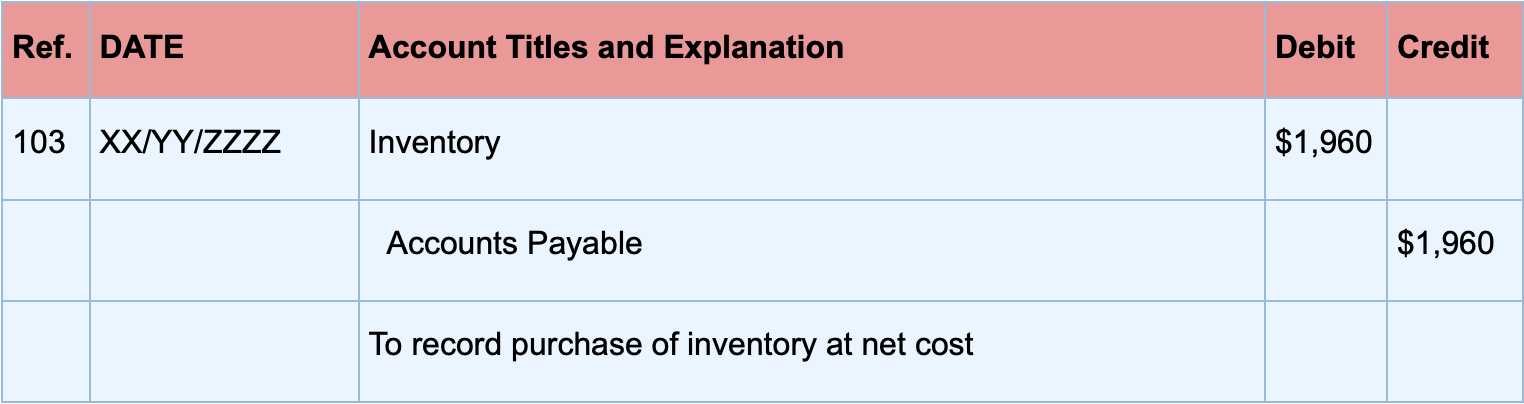

Typically, manufacturers and wholesalers will sell appurtenances on credit. These credit terms are written down in the seller's beak or invoice.

For the sake of our example, let'south assume that on Apr 1st, the company purchases another $two,000 worth of trade, on credit, with payment terms 2/ten cyberspace 30.

A 2/10 cyberspace 30 payment term means that the heir-apparent has 30 days to pay dorsum its vendor, simply can get a 2% discount if they pay within 10 days.

At present, Company XYZ records their purchases at net toll, which is the invoice price of $two,000 minus the 2% available disbelieve, which amounts to $40.

Therefore, the company volition record this purchase as follows:

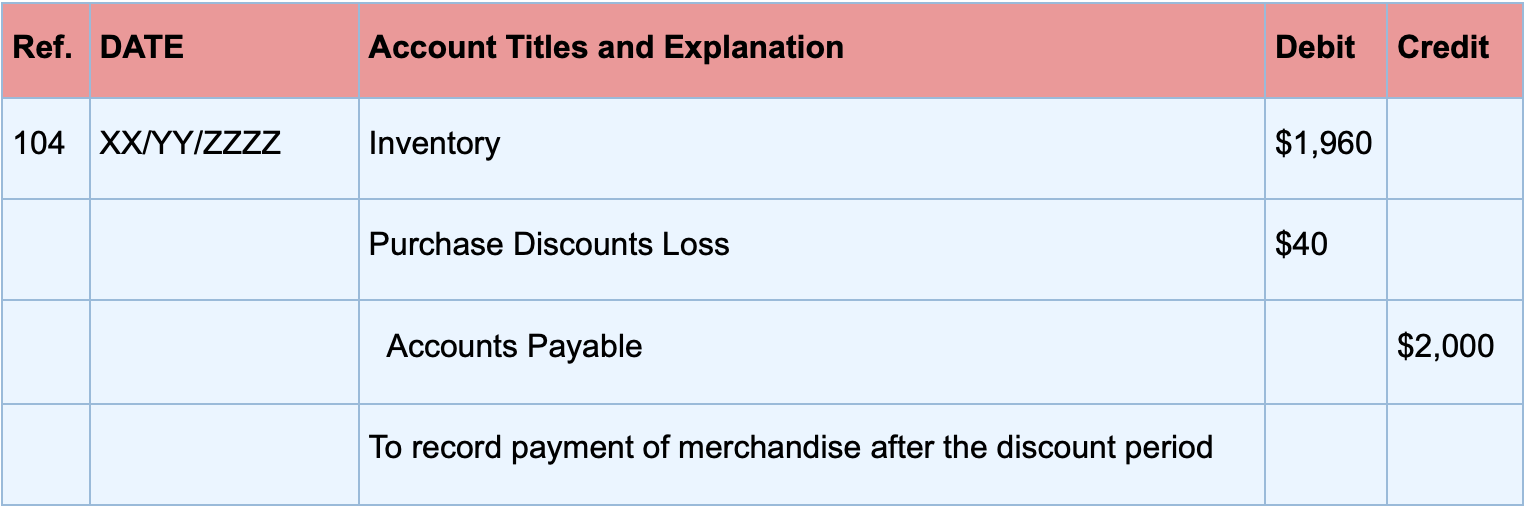

If the visitor fails to pay within 30 days, and losses the discount, the following periodical entry will be made to record the loss:

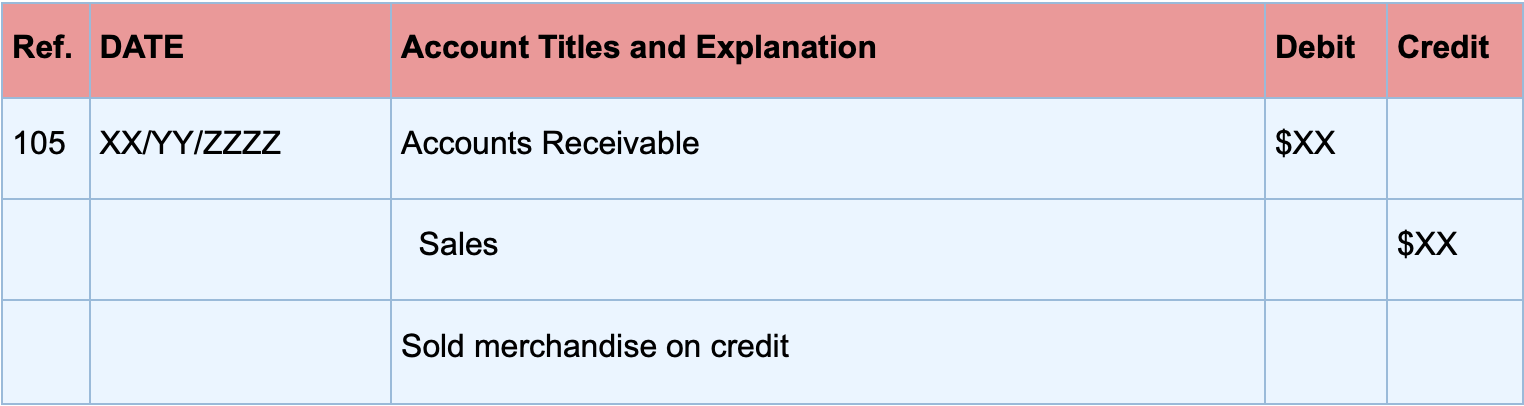

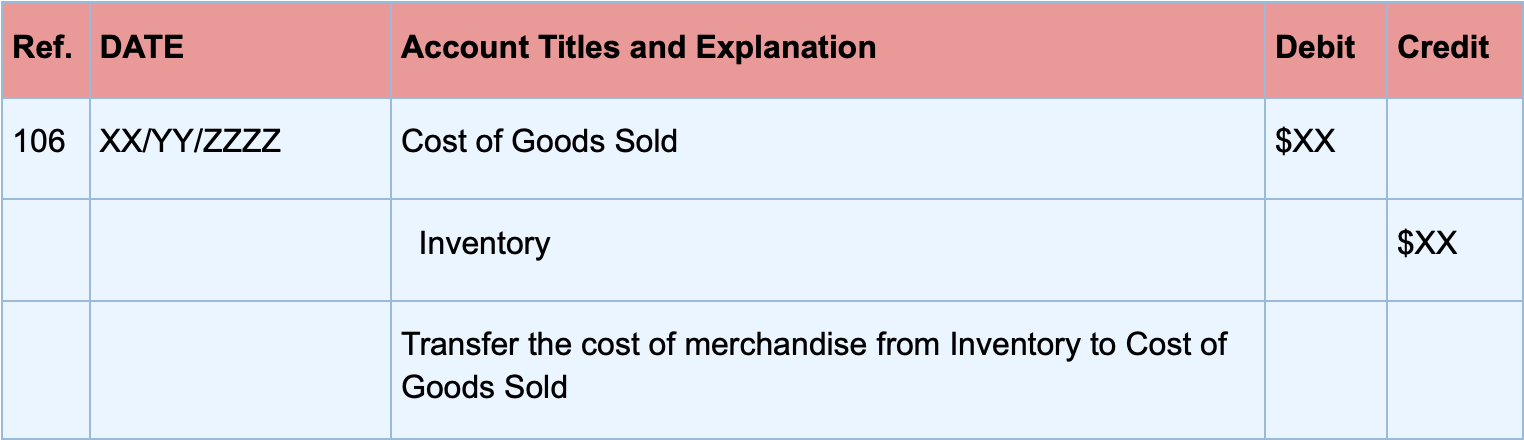

4. Sale of Merchandise

When a business sells merchandise, 2 periodical entries need to be created: i to recognize the sale, and another to record the costs of goods sold.

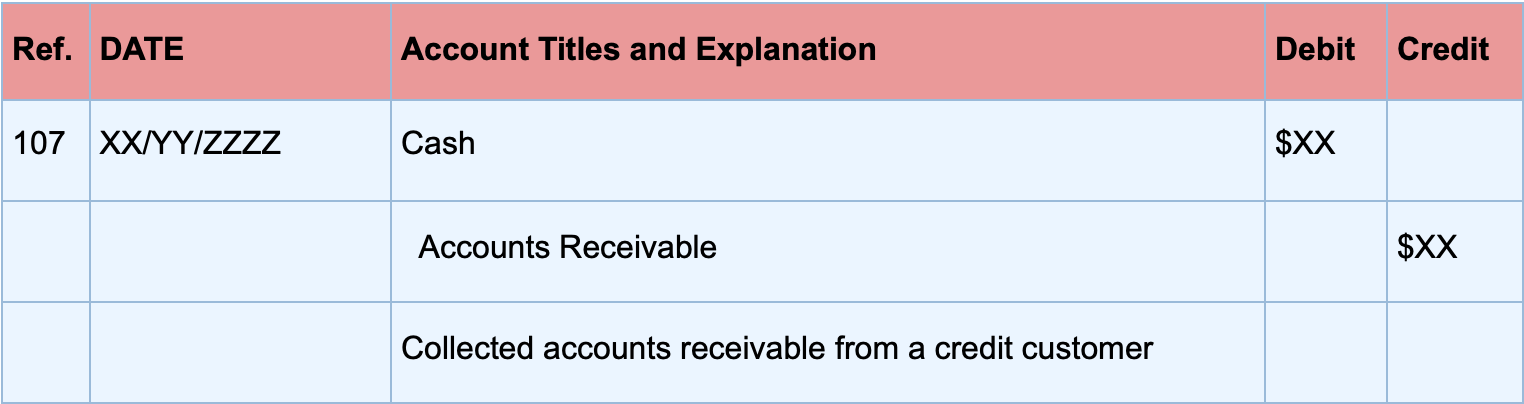

5. Collection of AR

Cash collection of accounts receivable is recorded equally shown below:

Want to learn more about the unlike types of accounts and how to properly journalize them? Head over to our guide on journalizing transactions , with definitions and examples for business.

Perpetual Inventory Arrangement with Deskera

By now you're probably convinced of the benefits and advantages that a perpetual inventory system can bring to your business.

And so, you might exist wondering, how do I cull the best inventory management software for my pocket-size business organization?

Well, the right perpetual inventory system volition help you lot automate nigh every part of your inventory management.

The Deskera inventory direction software is an intuitive, online software that helps you to manage and rail your inventory, prevent stock shortages, consequence credit notes for returns, operate multiple stores/warehouses, and ensure accurate record-keeping. All in 1 identify!

And that'southward not even the best role!

Deskera comes with both an intuitive online payroll and a client relationship management arrangement that will permit you to combine your most expensive business tools into ane affordable software.

Sign up for Deskera and beginning your complimentary trial now! No credit card details necessary.

Central Takeaways

A perpetual inventory arrangement will requite your business an accurate view of inventory and stock levels anytime, anywhere, without the problem of manually processing every transaction by hand.

At the same fourth dimension, the organization prevents error, helps you foreclose whatever imprecision, and allows you to manage multiple locations from one centralized place.

With the Deskera inventory management software, you can obtain all of these benefits and and then much more than, with every bit fiddling as $149 per yr, per user.

Related articles

Is Inventory a Electric current Asset?

Yes, inventory is considered a current asset. Current assets or short-term assets are accounts that track what a visitor ownsand expects to use within a year. And since inventory is intended to be soldwithin 12 months, it'south recorded as a current nugget in the rest sheet[/weblog/what-is-a-balance…

What Is a Business Expense? Know Your Deductibles

When running a small business, expenses are inevitable. After all, you take tospend money to brand coin. The proficient news is that equally a business possessor, you can accept advantage of theseexpenses to decrease your tax liabilities. When y'all're well aware of what business concern expenses to deduct, you can potent…

What Are Operating Expenses? Small Business Guide

Operating expenses are a crucial chemical element of the income statement. As the namesuggests, operating expenses are expenditures needed for running a firm'sday-to-day operations. When you're a minor business concern owner, information technology'southward your responsibility to determine andcalculate the operating expenses that your charabanc…

Source: https://www.deskera.com/blog/perpetual-inventory-system/

Posted by: caballerosholl1946.blogspot.com

0 Response to "Which Of The Following Statements Is False? In A Perpetual Inventory System, The "Cash Regist"

Post a Comment